Record Holders and Beneficial Owners — What is the difference between holding shares as a Record Holder versus a Beneficial Owner?

Most Ulta Beauty stockholders hold their shares through a broker or other nominee rather than directly in their own name. There are some distinctions between shares held of record and those owned beneficially:

Record Holders — If your shares are registered directly in your name with our Transfer Agent, American Stock Transfer & Trust Company, you are considered, with respect to those shares, the stockholder of record or Record Holder and the Notice was sent directly to you by Ulta Beauty. As the stockholder of record, you have the right to grant your voting proxy directly to Ulta Beauty or to vote by attending the Annual Meeting online.

Beneficial Owner — If your shares are held in a brokerage account or by another nominee, you are considered the Beneficial Owner of shares held in street name, and the Notice was forwarded to you from your broker, trustee, or nominee. As a Beneficial Owner, you have the right to direct your broker, trustee, or nominee how to vote and are also invited to attend the Annual Meeting by virtual presence. Since a Beneficial Owner is not the stockholder of record, you may not vote these shares at the meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting. Your broker, trustee or nominee has enclosed or provided voting instructions for you to use in directing how to vote your shares. If you do not provide specific voting instructions to your broker, your broker can only vote your shares with respect to “discretionary” items, and may not vote your shares with respect to “non-discretionary” items. All of the proposals on which stockholders are being asked to vote on at the Annual Meeting, with the exception of Proposal 2, the ratification of the appointment of our independent registered public accounting firm, are considered non-discretionary items. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

Voting — Who can vote and how do I vote?

Only holders of our common stock at the close of business on April 12, 2024 will be entitled to notice of and to vote at the Annual Meeting. At the close of business on April 12, 2024, we had outstanding and entitled to vote 47,935,024 shares of common stock. Each holder of our common stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

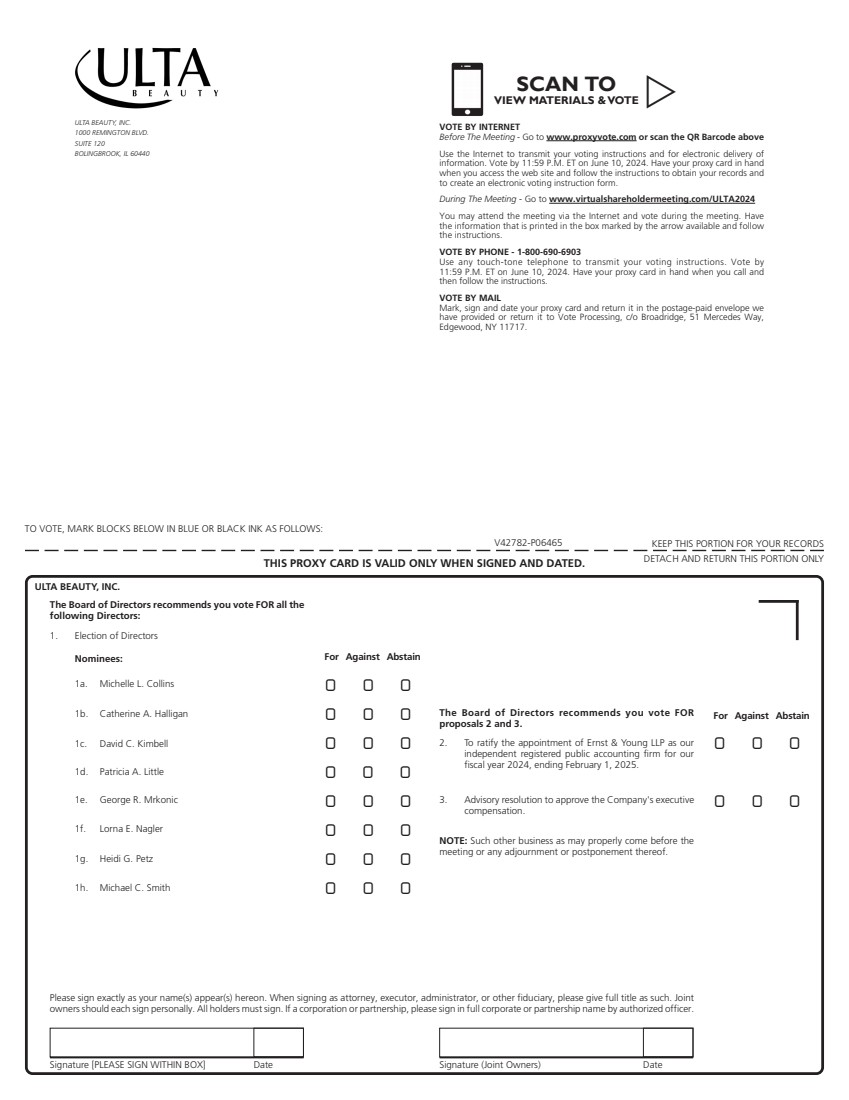

To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the Annual Meeting by virtual presence online. Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder of record, you may vote by proxy. You can vote by proxy over the internet or by telephone by following the instructions provided in the Notice, or if you requested to receive printed proxy materials, you can also vote by mail pursuant to instructions provided on the proxy card. If you hold shares beneficially in street name, you may also vote by proxy over the internet or by telephone (as applicable) by following the instructions provided in the Notice, or if you requested to receive printed proxy materials, you can also vote by mail, via the internet or telephone (as applicable) by following the voting instructions provided to you by your broker, bank, trustee, or nominee.

If you attend the Annual Meeting online, you may also submit your vote at www.virtualshareholdermeeting.com/ULTA2024 at the meeting, and any previous votes that you submitted will be superseded by the vote that you cast at the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain from the Record Holder and submit a legal proxy issued in your name.

If you have any questions or need assistance voting, please contact our proxy solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, New York 10022

Shareholders, banks and brokers may call: (212) 750-5833

1

1