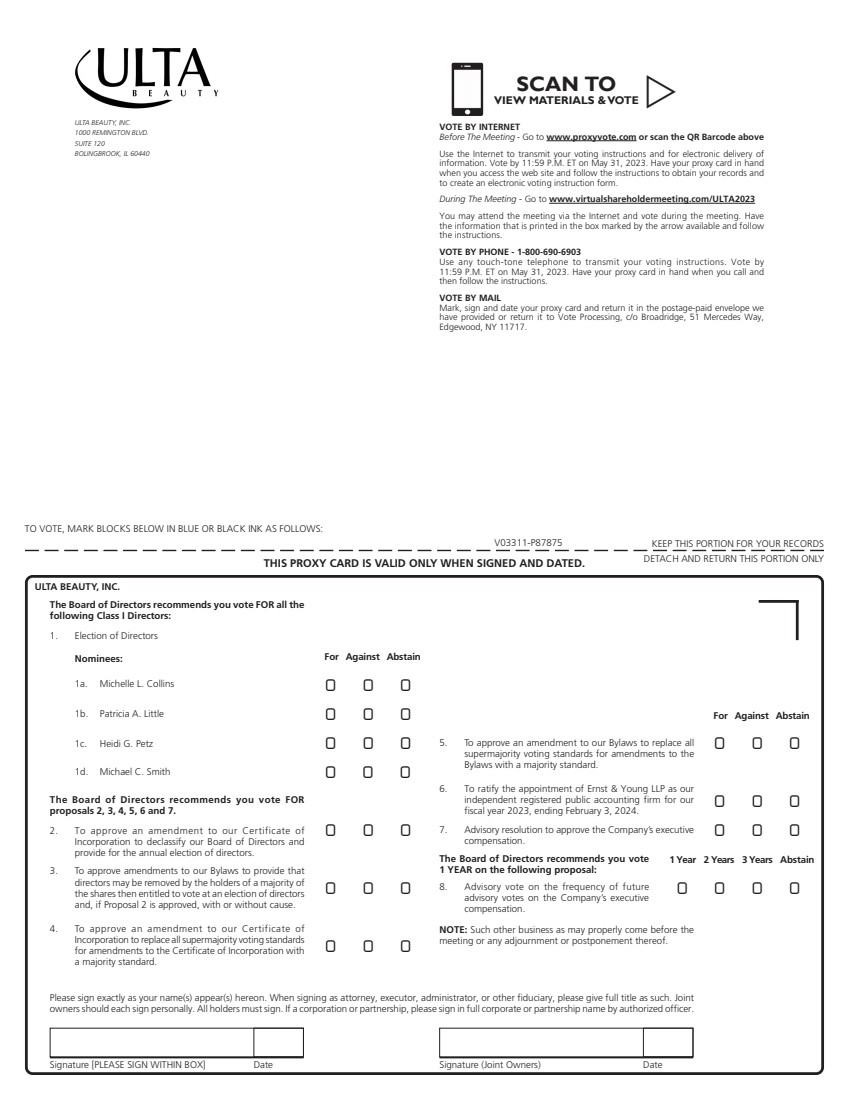

Notice of Annual Meeting of Stockholders

| When? | Where? | Who? |

|

|

| |

10:00 am CDT | Virtual meeting at www.virtualshareholdermeeting.com | Stockholders of Record |

Meeting Agenda

Proposals |

| Board |

| For more |

1. To elect Michelle L. Collins, Patricia A. Little, Heidi G. Petz, and Michael C. Smith as Class I Directors | FOR | Page 10 | ||

2. To approve an amendment to our Certificate of Incorporation to declassify our Board of Directors and provide for the annual election of directors | FOR | Page 19 | ||

3. To approve amendments to our Bylaws to provide that directors may be removed by the holders of a majority of the shares then entitled to vote at an election of directors and, if Proposal 2 is approved, with or without cause | FOR | Page 21 | ||

4. To approve an amendment to our Certificate of Incorporation to replace all supermajority voting standards for amendments to the Certificate of Incorporation with a majority standard | FOR | Page 22 | ||

5. To approve an amendment to our Bylaws to replace all supermajority voting standards for amendments to the Bylaws with a majority standard | FOR | Page 23 | ||

6. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year 2023, ending February 3, 2024 | FOR | Page 24 | ||

7. To vote on an advisory resolution to approve the Company’s executive compensation | FOR | Page 54 | ||

8. To vote on the frequency of future advisory votes on the Company’s executive compensation | 1 YEAR | Page 56 |

We will also consider any other matters that may properly be brought before the meeting or any adjournment or postponement thereof.

Virtual Meeting

We are holding the 2023 annual meeting online, in a virtual meeting (via live webcast) format. You will not be able to attend the annual meeting physically. You or your proxyholder can participate, vote, and examine our stockholder list at the annual meeting by visiting www.virtualshareholdermeeting.com/ULTA2023 and using your control number found on your proxy card. We believe that a virtual format provides improved communication and the opportunity for participation by a broader group of our stockholders, while reducing costs associated with planning, holding, and arranging logistics for an in-person meeting. In addition, hosting a virtual annual meeting reduces the environmental impact of our annual meeting.

1

1