NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| When? | Where? | Who? |

|

|

| |

10:00 am CDT | Virtual meeting at www.virtualshareholdermeeting.com/ULTA2021 | Stockholders of Record |

Meeting Agenda

Proposals |

| Board |

| For more |

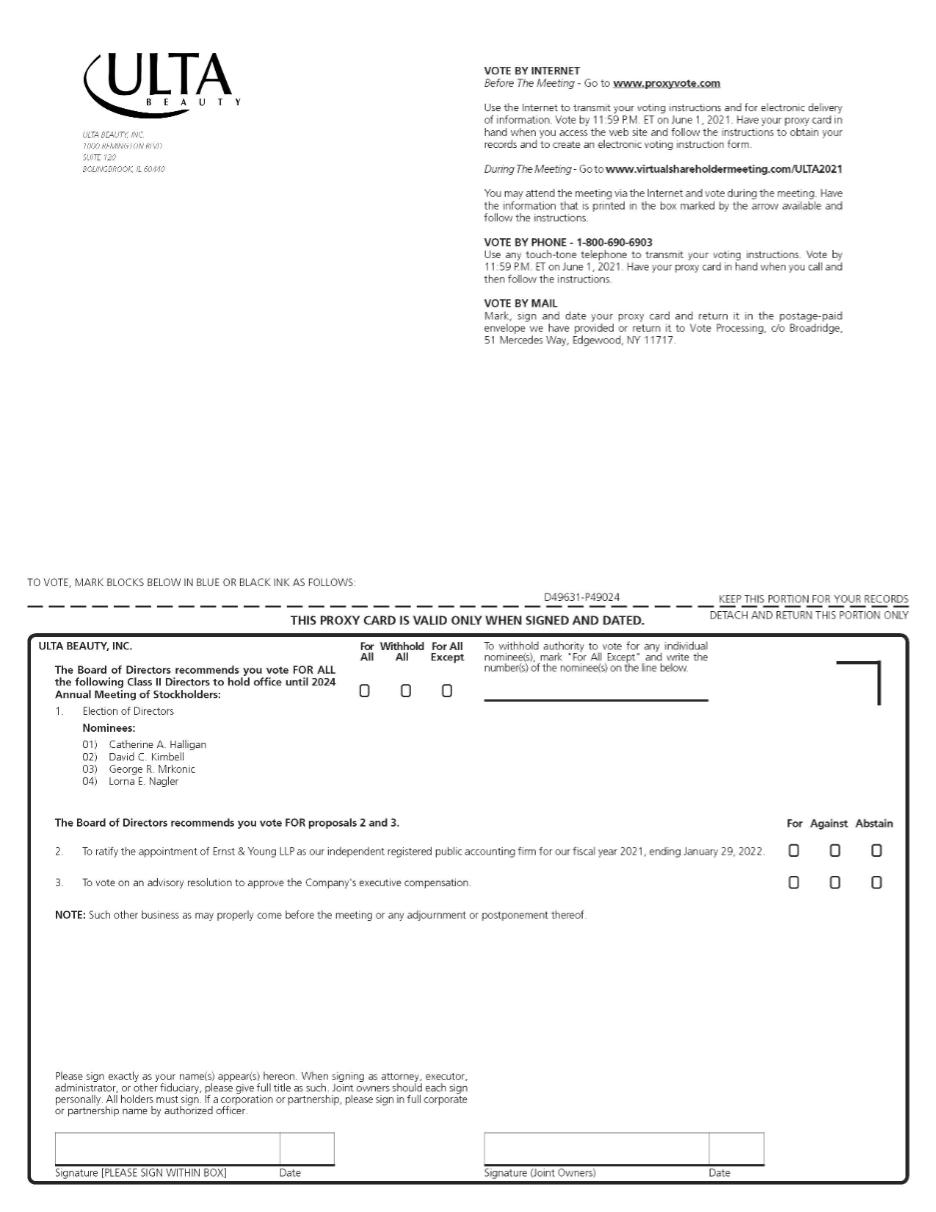

1. To elect Catherine A. Halligan, David C. Kimbell, George R. Mrkonic and Lorna E. Nagler as Class II Directors to hold office until the 2024 Annual Meeting of Stockholders | | FOR | | Page 9 |

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year 2021, ending January 29, 2022 | | FOR | | Page 20 |

3. To vote on an advisory resolution to approve the Company’s executive compensation | | FOR | | Page 50 |

We will also consider any other matters that may properly be brought before the meeting or any adjournment or postponement thereof.

Virtual Meeting

We are holding the 2021 annual meeting online, in a virtual meeting (via live webcast) format, due to an abundance of caution related to the continuing COVID-19 pandemic and the priority we place on the health and well-being of our stockholders, associates, and other stakeholders. You will not be able to attend the annual meeting physically. You or your proxyholder can participate, vote, and examine our stockholder list at the annual meeting by visiting www.virtualshareholdermeeting.com/ULTA2021 and using your control number found on your proxy card.

Voting

Stockholders of Ulta Beauty as of the record date are entitled to vote, as follows:

|

|

| |

Internet | Telephone | ||

www.proxyvote.com | 1-800-690-6903 | Mark, sign and date your proxy card and return it in the pre-addressed postage paid envelope we have provided or return it to: | |

www.proxyvote.com | or | For beneficial ownership: | For registered ownership: |

Your vote is important. Whether or not you plan to attend the meeting by virtual presence, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the notice of internet availability of proxy materials you received in the mail. If you received paper copies of the proxy materials, kindly mark, sign, and date the enclosed proxy card and return it promptly in the enclosed envelope (which is postage prepaid, if mailed in the United States). Even if you have given your proxy, you may still revoke your proxy and vote by attending the virtual meeting online. Please note, however, that if your shares are held by a broker, bank, or other nominee and you wish to vote at the meeting, you must obtain, from your broker, bank, or other nominee, the record holder, a proxy issued in your name. For specific instructions on voting, please refer to the section, Questions and Answers — Voting Information/page 56.

1

1